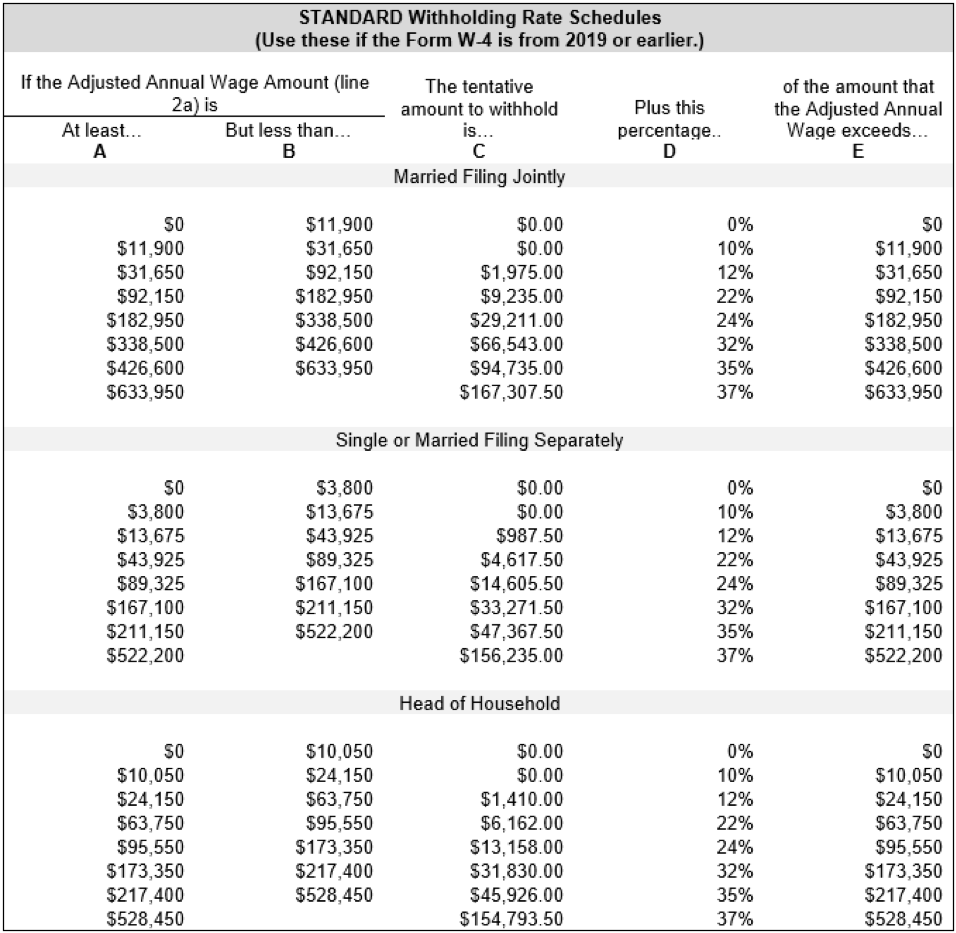

What Is The Federal Tax Rate 2025. For 2025, the seven federal income tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37%. Credits, deductions and income reported on other forms or schedules.

For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly). The excess income ($35,000 minus $11,600, or $23,400) will be taxed at 12%, yielding $2,808.

In 2025, the excess taxable income above which the 28% tax rate applies will likely be $116,300 for married taxpayers filing separate returns and $232,600 for all.

Tax rates for the 2025 year of assessment Just One Lap, This means there are higher tax rates for higher income. There are seven tax brackets for most ordinary income for the 2025 tax year:

Listed here are the federal tax brackets for 2025 vs. 2025 FinaPress, Your income each year determines which federal tax bracket you fall into and which of the seven income tax rates applies. These rates apply to your taxable income.

Tax Brackets 2025 Vs 2025 Usa Danya Modestia, Calculating the federal income tax rate. See current federal tax brackets and rates based on your income and filing status.

How Federal Tax Rates Work Full Report Tax Policy Center, For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly). In 2025, the excess taxable income above which the 28% tax rate applies will likely be $116,300 for married taxpayers filing separate returns and $232,600 for all.

tax rates 2025 vs 2025 Kami Cartwright, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. The federal income tax has seven tax rates in 2025:

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, For tax year 2025, or the taxes you file in april 2025, these are the tax brackets and income thresholds for the various filing statuses: In 2025, the excess taxable income above which the 28% tax rate applies will likely be $116,300 for married taxpayers filing separate returns and $232,600 for all.

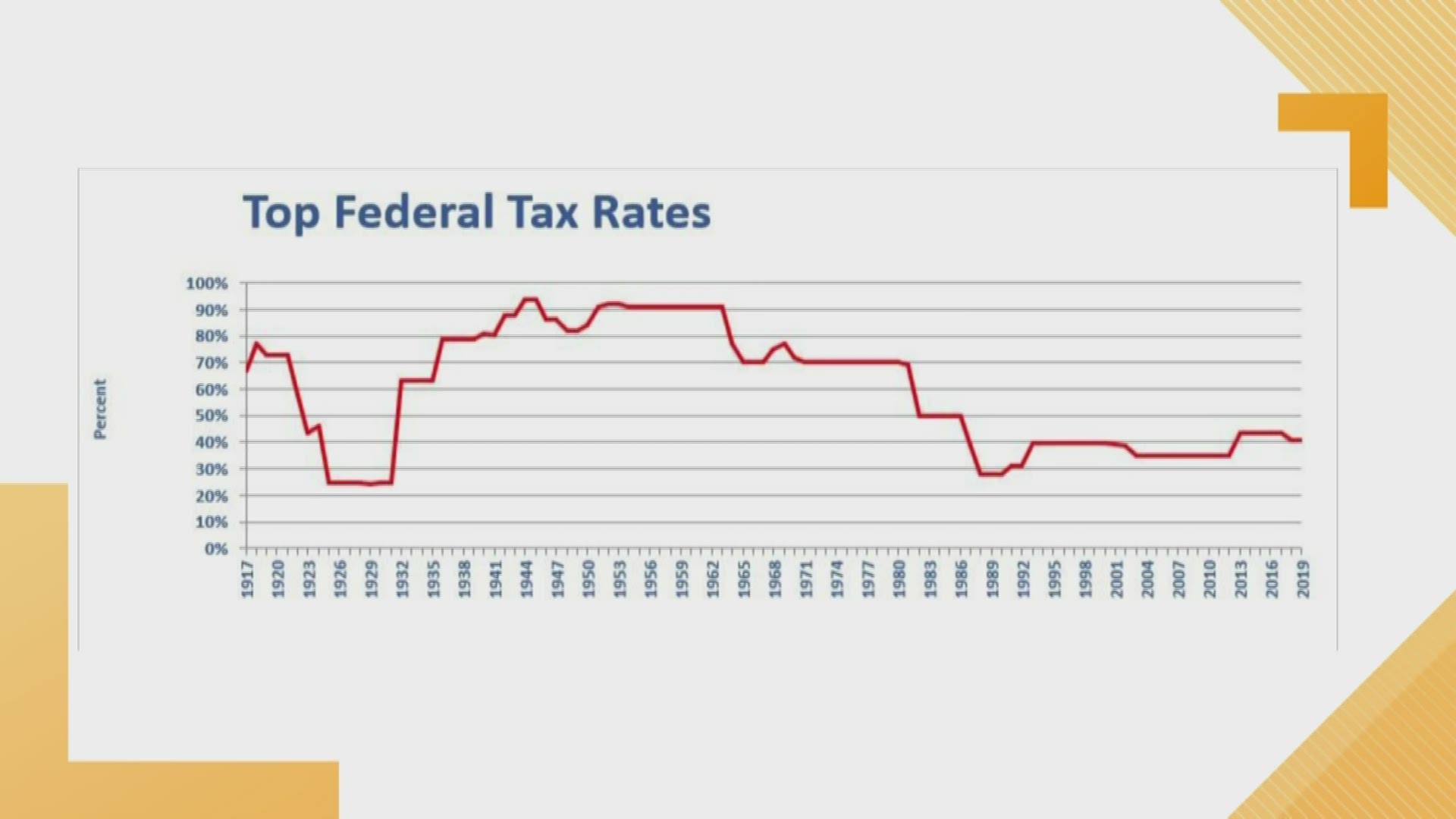

The History of Federal Tax Rates, For tax year 2025, or the taxes you file in april 2025, these are the tax brackets and income thresholds for the various filing statuses: Your taxable income is your income after various deductions, credits, and exemptions have been.

Calculation of Federal Employment Taxes Payroll Services The, You file a federal tax return as an individual and your combined income is between $25,000 and $34,000. Calculate your personal tax rate based on your adjusted gross income for the current.

T130241 Distribution of Federal Payroll and Taxes by Expanded, You file a federal tax return as an individual and your combined income is between $25,000 and $34,000. Credits, deductions and income reported on other forms or schedules.

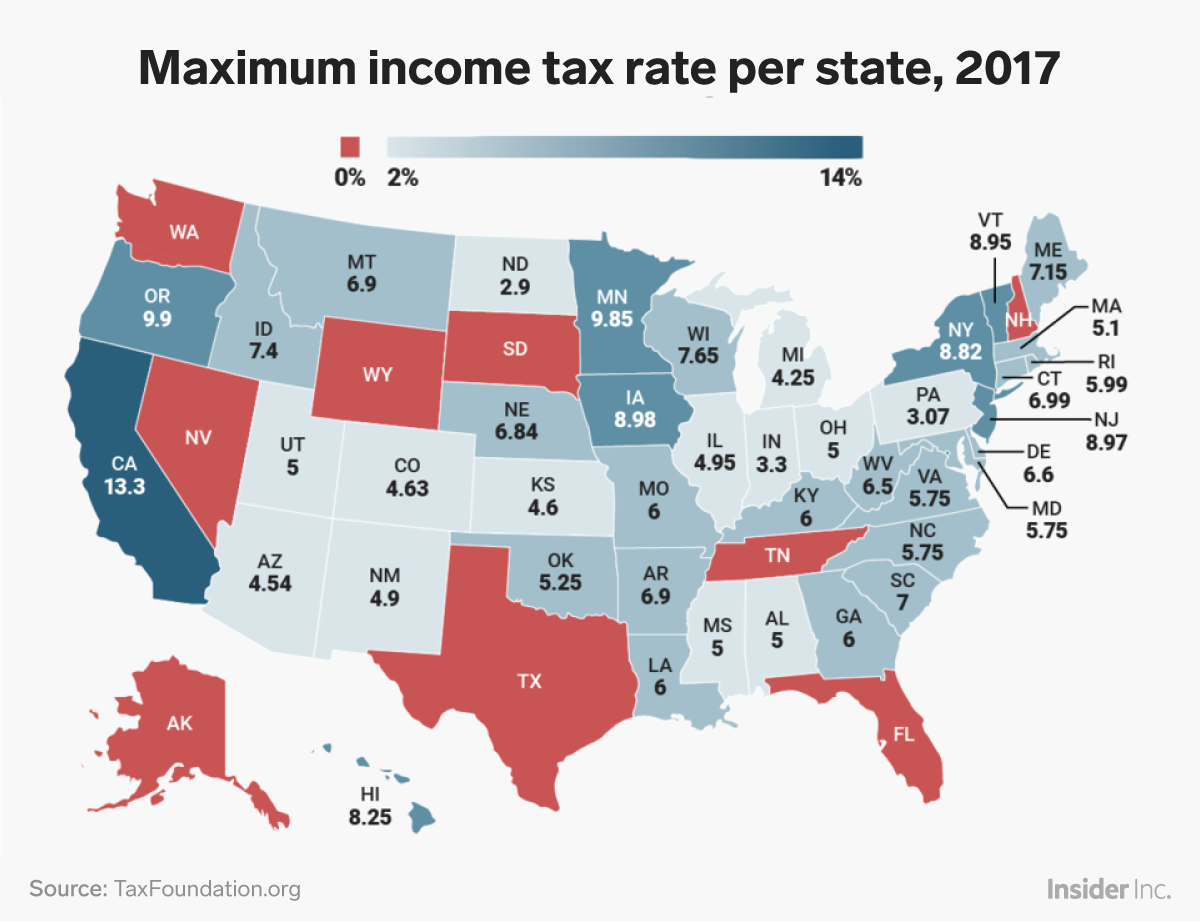

April 17 was Tax Day in the US. This map shows the tax rate per, You pay tax as a percentage of your income in layers called tax brackets. Your income each year determines which federal tax bracket you fall into and which of the seven income tax rates applies.

Concerts In San Antonio September 2025. Currently there are 590 upcoming events. The new year is starting. For amanda nguyen,[...]

When Tax Filing Start 2025. Remember, the tax filing deadline for 2025 taxes is monday, april 15, 2025. The deadline[...]

Iceland Travel Restrictions 2025. Iceland entry details and exceptions. Latest travel restrictions and bans The full extended comfort experience includes:.[...]